Complete our Portfolio Program Selector

Discover your property investment

potential by answering a few simple questions.

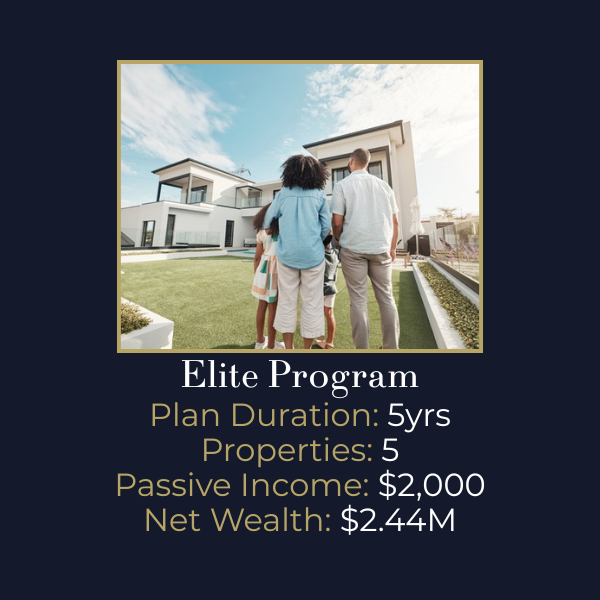

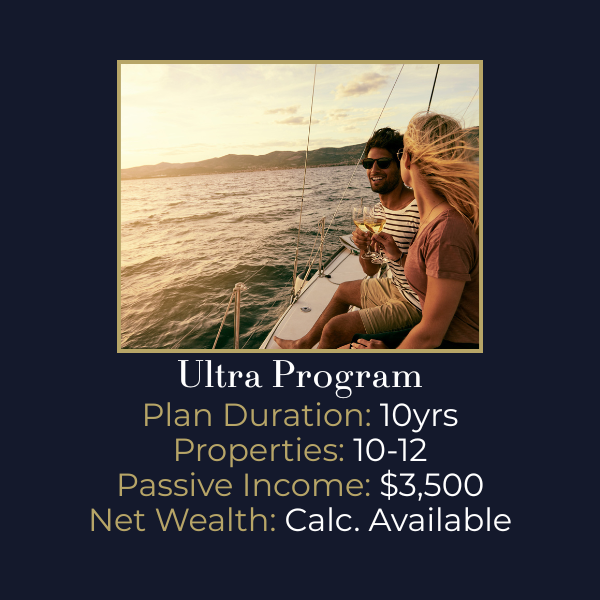

Ramsey Portfolio Programs are your personalised roadmap to financial freedom - tailored to your goals, timeline, and budget.

From first to 12th property, we provide expert planning, finance structuring, off-market property access, and ongoing support

to grow your net wealth.

30+ years experience in data-driven, strategic property investment, specialist mortgage advisory & investment property acquisition. Our holistic, customised approach provides tailored solutions to build your long-term wealth for the lifestyle you deserve.

.png)

Our average member generates over

per annum in passive income

net wealth

assets under our supervision

.png)

Bespoke Property Wealth Strategy

Strategic Planning Tailored to You – We align your timeline, income, risk appetite, and future goals to create a 5–10 year plan you can actually follow.

Expert Mortgage & Lending Solutions

In-House Finance & Lending Experts – Access industry-leading debt structuring and get finance fit for future growth

High-Growth Property Portfolio

Premium Buyer Access – Tap into pre-market, off-market, and crashed contract opportunities with our national buyer network.

Holds us Accountable to Performance

On-Call Advice, Year-Round – Quarterly reviews, ongoing coaching, and performance tracking that keeps your portfolio compounding.

At Ramsey Property Wealth, we know that trust must be earned - and kept. That’s why we don’t just make promises. We stand behind our advice and execution with industry-leading guarantees designed to give you clarity, confidence, and control from the outset. These aren’t just marketing lines, they’re contractual commitments that reflect our integrity and accountability at every step of your investment journey.

Independence, Guaranteed - Or Your Money Back. We do

not accept commissions, referral fees, or incentives from developers, agents, or sellers. If we ever breach this—or fail to disclose a

builder referral—we’ll refund 100% of all fees paid. Because your trust is not negotiable.

100% Money-Back Guarantee. If You Don’t See the Value, You Don’t Pay. If

you’re not satisfied with the clarity, direction, or strategy at the end of your planning phase, we refund your full fee. No fine

print. No exceptions.

Property Secured in 90 Days, Or You Don’t Pay a Cent. We will find and secure a

property that meets your brief within 90 days—or we refund your Buyers Advocacy fee. We back our speed, access, and precision.

Results Backed by Financial Accountability. If your net property wealth doesn’t meet or

exceed our projections at the end of your 12-month program, we apply a 30% credit toward your next year. You won’t just get

advice - you’ll get results.

Building wealth is not for the feint of heart! It requires ambition, capital, and risk! Many of us don't come from families who have already

figured out how to achieve this, or families that can provide fallback support if things go sideways.

So what do we do? We form business partnerships with experts to help us make the right choices and minimize our risk! This is what

Ramsey Property Wealth will do for you.

As a single woman on a median salary, I am delightfully impressed and immensely grateful for the advice and support I received from Steve and his team. Not only was I listened to, my goal to live in my own property and acquire an investment property were realised according to my personal and unique circumstances. Steve was an excellent advocate to the banks and ensured my loan was approved, despite...

Steve and Acacia were both extremely professional in our dealings with them whilst we transferred our mortgage to another lender.

Their time, expertise and patience answering all our questions & helping us navigate the entire process was nothing but professional and very much appreciated.We highly recommend Ramsey Property Wealth! Craig & Nicky

At Ramsey Group, we believe that property investment is not just about accumulating wealth—it is about creating long-term financial security, ethical investment strategies, and providing essential housing solutions that contribute to Australia’s economic and social well-being.

Our mission is clear: To empower lives through trust, passion, and wealth creation.

We exist to transform the property investment industry through education, ethical investment, and a duty-bound approach to financial empowerment.

.png)

We typically spend 200+ hours identifying the right properties for you.

We take the time, so that you don't have to.

Disclaimer

The results produced by Ramsey Property Wealth are

estimates only. The projections are not guaranteed because they are only based on limited information about the

client’s circumstances and the projections include assumptions about the future which may not happen.

For example, future investment returns and the economy (inflation, interest rates, etc.) are assumed to be steady and predictable, whereas in reality they will fluctuate and may turn out to be higher or lower than assumed. Plus, the current legislative environment is in place for the length of the projections, whereas, in reality, legislation may change. Also note that changes announced in a budget will only be implemented when they have passed both Houses of Parliament and been given Royal Assent.

Important warnings, disclaimers and disclosures

The advice in this document is based on our knowledge of your personal and financial situation, needs and objectives as advised by you and

as set out in this document from data you supplied. If our information is inaccurate or incomplete the advice may not be appropriate. For

this reason, we ask that you please advise us immediately if there are any material changes, errors or omissions in respect to your

circumstances as they are set out within this document and its attachments if any. We strongly suggest you do this before you act on any of

our advice. This Property Portfolio Plan has been prepared for your use only and should not be used as a guide by any other person.

This Property Strategy is not to be interpreted as specific financial advice as this would need to be completed under a Statement of Advice.

Any comments in this Property Strategy that are of a Financial Planning nature are General Advice only.

Ramsey Property Wealth is not a financial advisor. You should consider independent legal, financial, taxation or other advice to ascertain how our property advice applies to your unique circumstances. Investment return projections are based on historical average performance of actual or simulated returns. Performance data shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. Therefore, the stated figures should not be relied upon. The investment return and principal value of an investment will fluctuate so that an investor’s investments, when redeemed, may be worth more or less than their original cost. You should seek and be satisfied with your own legal and financial advice and carry out any other research necessary before making financial decisions.

No representation, guarantee, warranty etc.

We make no representation, guarantee, warranty, promises or undertaking as to the: (i) suitability of any properties purchased or sold by

you; or (ii) any financial viability or guarantee in respect of your property purchases or sales. You should make your own enquiries before

any property purchases or sales, including obtaining the appropriate legal and financial advice. To the maximum extent allowable by law, we,

our agents, and employees will not be liable for any loss or damage suffered or incurred by you in relation to

any property purchase or sale.

Property as an investment – disclaimer

Property is generally a

relatively illiquid asset class and it is often difficult to gain access to funds quickly if the asset needs to be sold. While Ramsey

Property Wealth recommends the ownership of property with a solid rental yield, residential property can also incur repairs costs and

there may also be periods where the property is vacant, and no rental income is received. For the above reasons we consider that

property is generally most effective as a long-term investment (minimum 10 years), with time in the market allowing both the rental

income and the market value of the property time to grow and compound in a tax-efficient manner. Therefore, it is also considered

important to maintain a reasonable cash buffer in case of unforeseen repairs costs or vacancy periods.

Variance Analysis – Interest Repayments

Future interest rates cannot be reliably predicted.

Therefore, it is recommended that a robust cash buffer is maintained to cover potential vacancies, repairs, levies, as well as unforeseen increases in mortgage repayments.

While the cash flow from these events may remain negative, in a high growth scenario over time a substantial pool of equity can be generated from these assets.

Interest rates on variable rate products may increase or decrease in the future, and therefore the impact of potential future hikes to interest rates need to be considered in the context of the below estimates and projections

Property values do not typically rise or fall in a linear fashion. Prices may stagnate or fall for significant periods of time through a market cycle.

Retention of information

You have provided us with your information and have granted us permission to retain the information on our files and provide details as

required to product issuers.

Disclosure of fees and commissions

The fee for our preparation of this report has been agreed in our contract. An invoice for this amount has already been issued and paid. The

fees represent work done and a fee-for-service in respect of this report only. Ramsey Property Wealth does not receive any

commissions or ongoing commissions from other sources with the potential exception of our Finance referral Where this eventuates, the

commissions will be disclosed up front and in writing by the Finance Broker. Any subsequent work related to the sourcing, purchase or

sale of investment properties will be the subject of a separate engagement and billed separately.

Conflicts of interest

Aside from the commissions we potentially receive from Business partners for referrals , Ramsey Property Wealth and I do not have any other

relationships that may create a conflict of interest or potentially influence our advice to you.