Property cycles: When should you invest?

Constant headlines, media speculation and the weekend conversation amongst family and friends will likely confuse you about the right time to invest in property.

To better understand the Australian housing market, we wish to leave you with the tools to recognise it goes through a property cycle.

That is a series of phases our property market moves through over time in a repeated pattern.

Over the long term, Australian housing prices have risen but don't increase at the same rate each year. As we saw over the last few years, a period of rising values has been followed by a property market that has seen prices stagnate or fall.

When you understand this cycle, you can be better informed when making decisions about investing.

Critically, being able to ignore the hype and realistically assess where a specific location or property is within the cycle will guide you on what it’s most likely to occur.

When you understand the property market cycle, you can purchase in a stable or rising market before you add equity to guard against a future downturn.

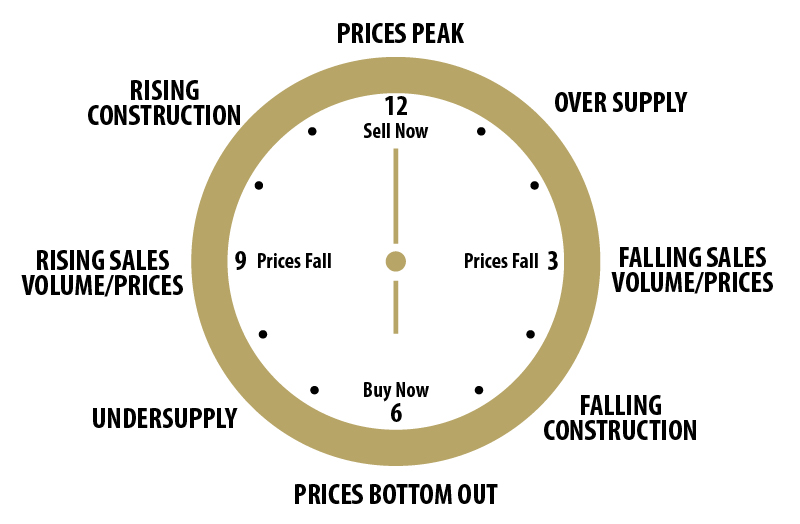

Here's a visual representation of the property clock:

The upswing starts at around seven on the clock face and continues until the peak of the market, at twelve.

Then it is on the downswing.

The bottom of the market is at six.

It's essential to avoid buying in booming marketing and buy a property in a rising market, as you lose equity almost immediately.

Ideally, using the property clock, you should buy at around seven or eight on the clock face to capitalise on the growth that is likely to

occur.

In Australia, how long does the property cycle last?

Knowing when the market has bottomed out or when housing prices will increase is challenging.

You should know that several macro and microeconomic factors determine the property market cycle. This can include many political and social issues, such as population growth (or decrease), infrastructure investment and employment levels.

Is the property cycle the same across Australia?

Historically, Australian property cycles have generally lasted around eight years, with two years of solid activity and increasing prices, followed by up to six years of a relatively stable market.

It's important to note that the national property market is inconsistent. For example, some capital cities and regions have seen their highest median property prices over the last few years, whereas others have posted marginal or negative growth.

Cycles don't necessarily fall into line simply because several years have passed. For example, average Australian capital city prices have experienced multiple cycles over the past seventeen years. Since the turn of the century, periods that have had booms include 2003, 2007, 2010, 2017 and, of course, 2021/22.

One of the critical factors driving national property cycles is interest rates, with periods of rate cuts eventually causing upswings in the property cycle.

Interest rates and strong population growth since 2001 have driven demand, with buyer affordability increased due to job security and low unemployment.

In Australia, rising property prices can be attributed to insufficient housing being constructed to meet demand. In addition, Sydney and Melbourne have seen significant population growth during the last two decades, increasing demand for housing alongside continued investor interest.

Finally, the banks also contribute to the cycle. As most people can't afford to purchase a home based on their savings, they usually take

out a home loan. Depending on how much the banks can lend and align to regulatory conditions, the demand in the housing market can, to an

extent, be controlled.

Do you want to learn more about investing and understanding property cycles?

We offer consultative, strategic advice regarding planning and setting your property portfolio up for success, ensuring you are fully informed at each step.

Our Property Investment Advisors provide comprehensive advice around debt structure so you can reduce your debt to unlock equity for reinvestment in your next property.

Notably, our Property Investment Advisors can equip you with knowledge of the Australian housing market and its cycles which, in turn, assists you in executing a long-term strategy so you can move towards your lifestyle and financial goals confidently, regardless of fluctuations in market conditions.