Refinance to escape the fixed-rate cliff

Recently, former Reserve Bank Governor Ian Macfarlane warned that the banking regulator, APRA, will likely have to relax loan serviceability buffers if fixed-rate mortgage holders struggle to refinance their loans.

The former governor told a podcast hosted by private wealth firm Stanford Brown that the fixed-rate mortgage cliff is a severe issue.

He fears the fixed rate' rate' mortgage cliff'' is a serious concern for many Australian households and believes the federal government may have to step in with additional lending if the situation deteriorates further.

Macfarlane says that the last thing that banks want to do is foreclose on a borrower, and if things "really got nasty, there would have to be some form of additional lending from government".

He also told podcast listeners that the most probable economic scenario is that inflation will remain sticky over the next 2 - 3 years, with rising interest rates to help to tame it. This scenario shouldn't be seen as scary as the current period is a return to economic normality after the RBA kept rates too low for too long.

The RBA estimates around 800,000 fixed-rate home loans expire this year, equating to approximately $350 billion in credit set to roll from fixed to variable.

Between May and July, about 270,000 of these loans will expire.

The chart below shows that record numbers of fixed-rate home loans expired in May, with additional large volumes scheduled to expire throughout the remainder of 2023:

.jpg)

Many households will experience a piercing reset from ultra-cheap rates of around 2% to variable rates nearing 6% or beyond.

This increase in interest rates will see monthly loan repayments surge by around 50% for these borrowers.

Soaring interest rates, alongside the fixed-rate mortgage reset, have driven a boom in refinancing activity.

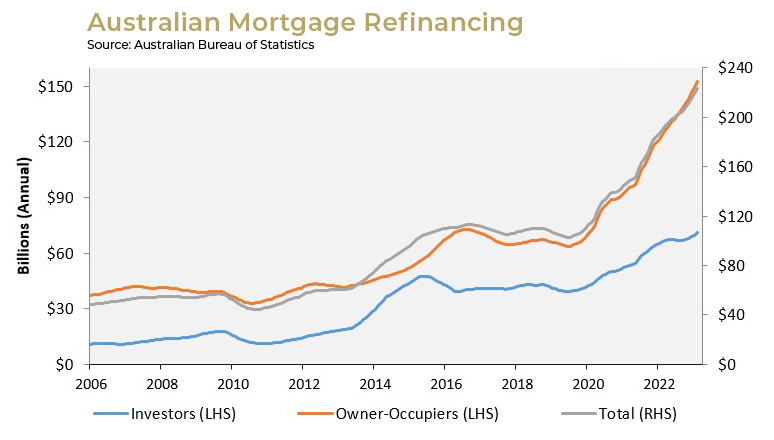

Data released in late May by the Australian Bureau of Statistics showed that borrowers refinanced $226 billion worth of home loans in the year to April - nearly double the pre-pandemic level:

Owner-occupiers have driven this refinancing activity, with loan volumes more than doubled since the pandemic's start.

Meanwhile, the RBA assistant governor (financial system), Brad Jones, told a Senate Estimates Committee in May that 15% of variable-rate

borrowers would face negative cash flow by December 2023 as their loan repayments climb above their disposable income.

Many households will face increasing difficulties in the months ahead as their ultra-low fixed-rate home loans reset to at least double their current levels.

However, by refinancing to one of the market's lowest variable rates, borrowers can save themselves thousands of dollars in mortgage payments each year.

Ramsey Property Wealth has access to hundreds of loan products, where you could save thousands of dollars in home loan repayments.

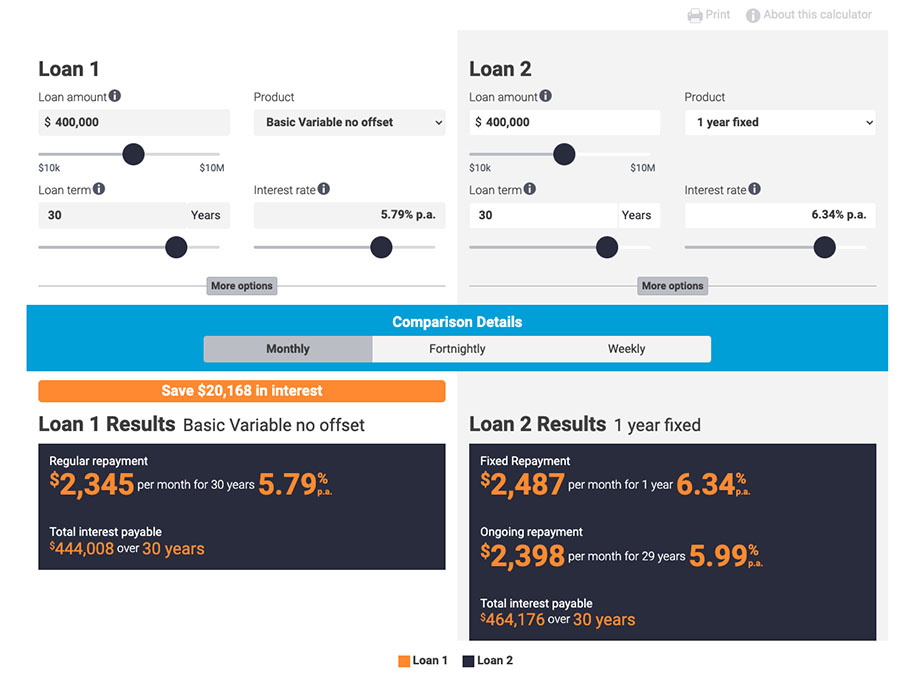

To see how Ramsey Property Wealth could help you, try our Loan Comparison Calculator.

To get started, enter the details of your existing loan on the left, including:

- Current loan balance

- Product (home loan type)

- Remaining loan term

- Current variable interest rate

Suppose your current variable interest rate is 6.00% when the fixed-rate rate expires.

Now, on the right, enter your loan balance and remaining term again.

But this time, select one of our packages to see the different interest rate options you can choose.

Depending on your circumstances, you may be eligible for a professional loan package, which at the time of writing, the comparison interest rate was 5.59%.

The tool will automatically update to show you the interest savings over the loan term by refinancing.

You can save by aligning your home loan repayments with your salary schedule.

By paying your home loan fortnightly or weekly, you can discover how much more you can save over the loan term.

Consider you’re a borrower who would like to refinance a $700,000 loan, and with your current lender, you will be switching to a new variable interest rate of 6% when the fixed-rate term ends.

With Ramsey Property Wealth, you can save over $65,000 in interest by refinancing to a professional package loan (5.59%) with weekly repayments.

Your lower home loan repayments could save you nearly $200 monthly ($2,400 annually).[1]

Our Loan Comparison Tool is just the start of how we could help you reduce your home loan repayments, ease the soaring cost of living, and assist you in regaining control of your finances.

If you're ready to start saving, contact our Mortgage Advice team for a complimentary 15-minute Discovery Call to review your current home loan.